This text on Blazecc Com Settle for will inform all readers by way of the method of bank cards issued by Blaze Firm. Do you frequent eating

Category: Finance

Legal defiance to Study Person Loan Forgiveness Loom Before Midterms

The Biden administration and Republican opponents of mass student debt cancellation appear going to a legitimate confrontation with countless vast amounts of dollars on the

What Does It Take to Get Credit Card Approval?

When someone applies for a credit card, the person likely wishes to know if the application received approval. No one wants to wait forever and

Manage Your Money With Personal Finance And Personal Loan

Personal finance is a term that incorporates matters related to managing money. It is simply a procedure of planning, tracking your expenses and saving money,

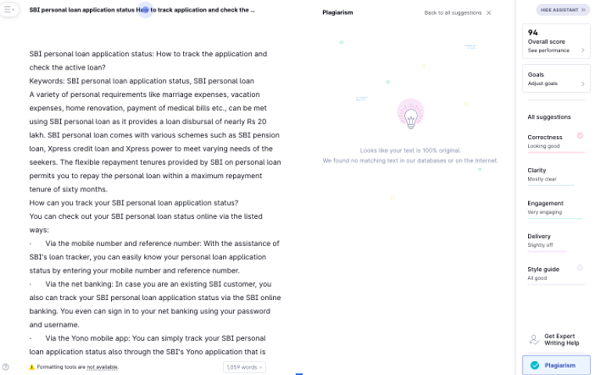

SBI personal loan application status: How to track the application and check the active loan?

A variety of personal requirements like marriage expenses, vacation expenses, home renovation, payment of medical bills etc., can be met using SBI personal loan as it provides

Do All Banks Have Online Accounts Now?

Since banks have physical locations that take up space and employ staff, there is a limit on how many they can have. This leads some

Ultimate Guide to Financial Terminology

Data, predictions, and values may be intimidating for non-finance professionals. You may, however, improve your professional performance and have a bigger effect on your firm

Role of Loan against Gold Funds in Making Emergency Payments

Households across India store gold items worth about $1.5 trillion, as per the current market value of this yellow metal. This is the largest private